For more information on RDPs, get FTB Pub. When we use the initials RDP they refer to both a California registered domestic “partner” and a California registered domestic “partnership,” as applicable. Registered Domestic Partners (RDPs)įor purposes of California income tax, references to a spouse, husband, or wife also refer to a California RDP, unless otherwise specified. Taxpayers should not consider the instructions as authoritative law.

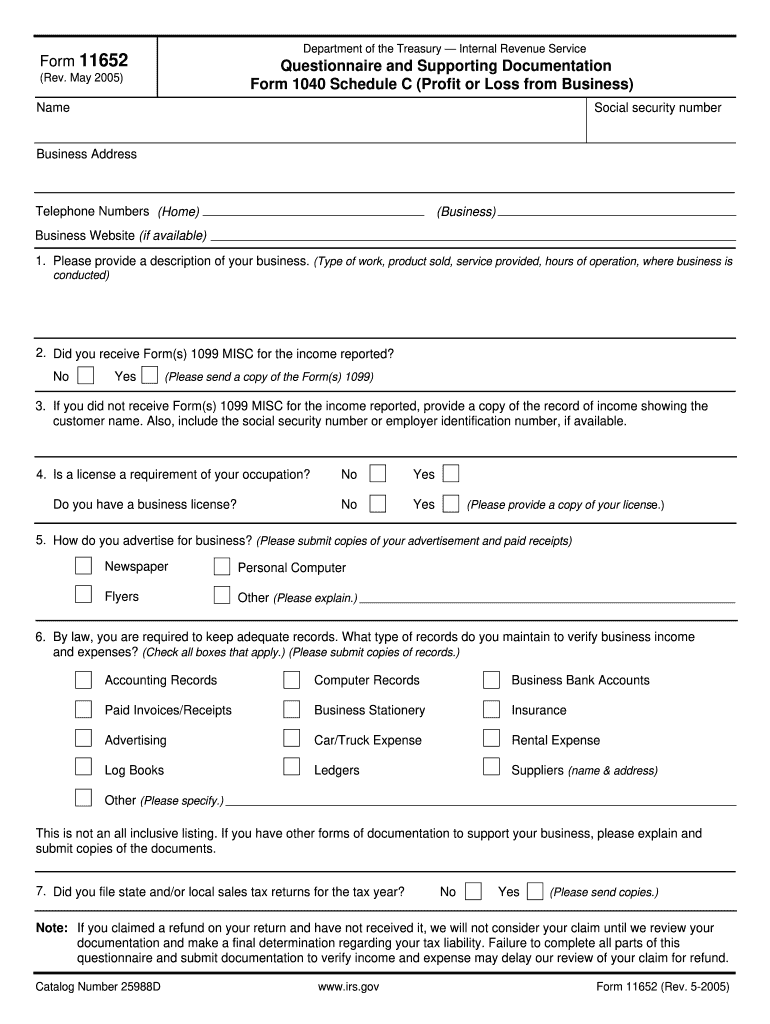

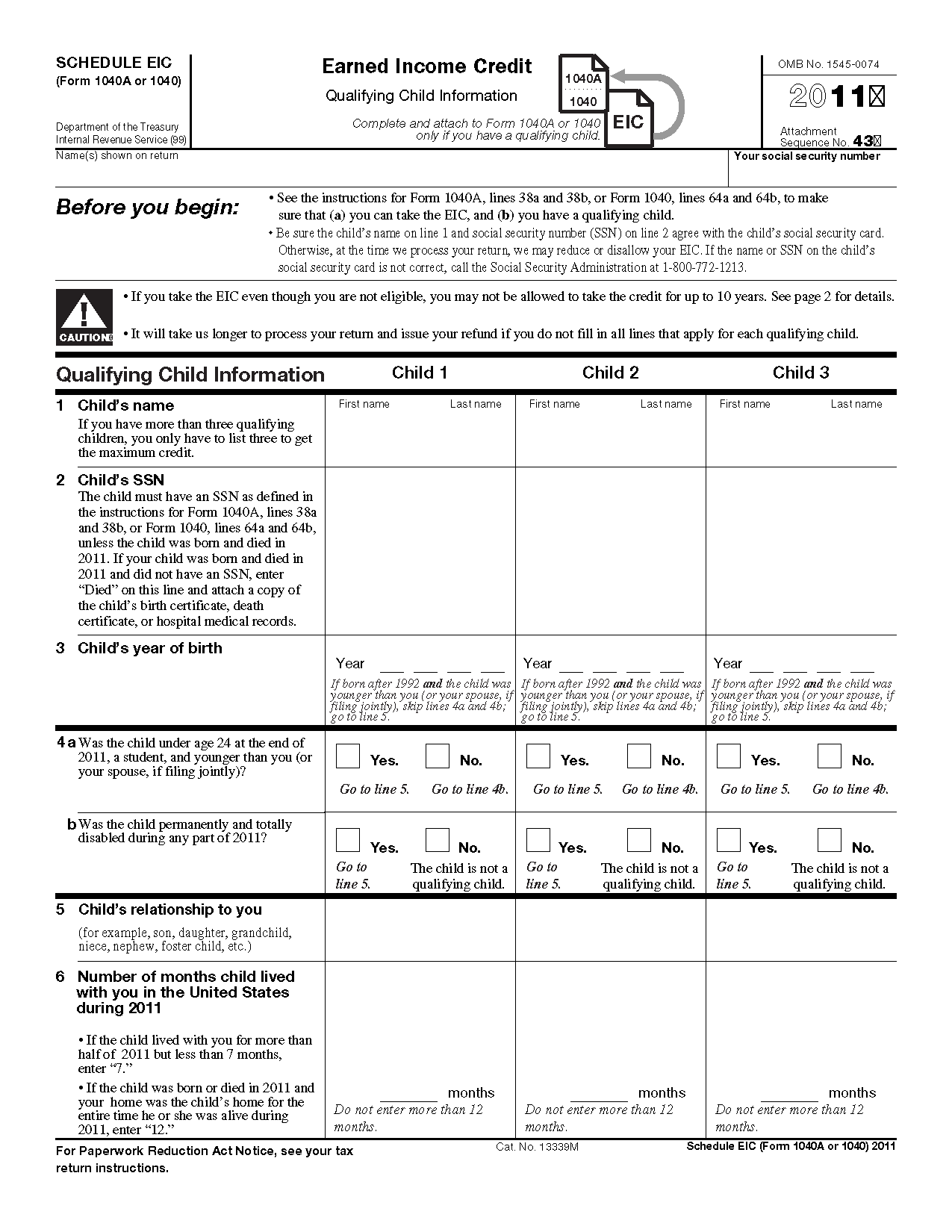

#FORMS TO GO WITH EITC CODE#

It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the instructions. We include information that is most useful to the greatest number of taxpayers in the limited space available. The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. 1001, Supplemental Guidelines to California Adjustments, the instructions for California Schedule CA (540), California Adjustments - Residents, or Schedule CA (540NR), California Adjustments - Nonresidents or Part-Year Residents, and the Business Entity tax booklets. Additional information can be found in FTB Pub. For more information, go to ftb.ca.gov and search for conformity. When California conforms to federal tax law changes, we do not always adopt all of the changes made at the federal level. However, there are continuing differences between California and federal law. In general, for taxable years beginning on or after January 1, 2015, California law conforms to the Internal Revenue Code (IRC) as of January 1, 2015. For more information, see General Information B, Differences in California and Federal Law and Specific Instructions, Step 5, line 13 and line 18. Worker Status: Employees and Independent Contractors – Some individuals may be classified as independent contractors for federal purposes and employees for California purposes, which may also cause changes in how their income and deductions are classified. For more information, see Specific Instructions for line 7 and go to ftb.ca.gov and search for eitc. The YCTC is available if the eligible individual or spouse has a qualifying child younger than six years old. Additionally, upon receiving a valid SSN, the individual should notify the FTB in the time and manner prescribed by the FTB. Any valid SSN can be used, not only those that are valid for work. If an ITIN is used, eligible individuals should provide identifying documents upon request of the Franchise Tax Board (FTB). What's NewĮxpansion for Credits Eligibility – For taxable years beginning on or after January 1, 2020, California expanded Earned Income Tax Credit (EITC) and Young Child Tax Credit (YCTC) eligibility to allow either the federal Individual Tax Identification Number (ITIN) or the Social Security Number (SSN) to be used by all eligible individuals, their spouses, and qualifying children. References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).

0 kommentar(er)

0 kommentar(er)